The retained earnings account has a credit balance of 37000 – The retained earnings account, holding a substantial credit balance of $37,000, offers valuable insights into a company’s financial health and strategic direction. This detailed examination delves into the sources, uses, and implications of retained earnings, providing a comprehensive understanding of this crucial financial metric.

Retained earnings, representing the cumulative profits retained by a company after dividends have been paid, serve as a cornerstone of financial stability and growth. By analyzing the retained earnings account, stakeholders can assess a company’s ability to fund future operations, expand its business, and reward shareholders.

Overview of Retained Earnings

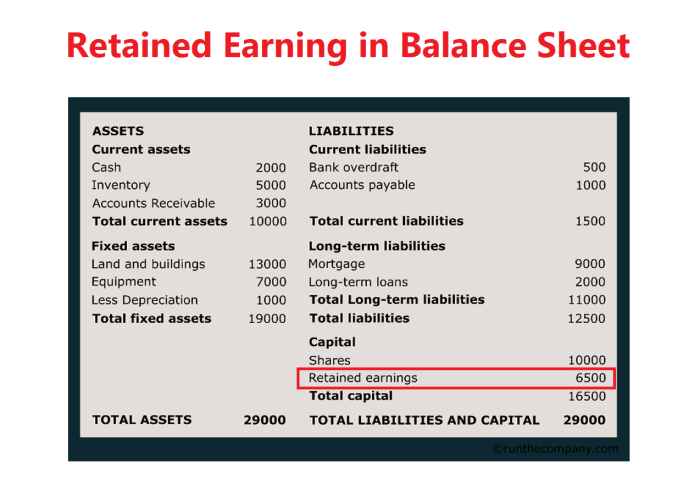

Retained earnings refer to the cumulative net income of a company that has been retained for reinvestment or other purposes, rather than being distributed as dividends to shareholders. Retained earnings are an important financial metric that provides insights into a company’s financial performance and its ability to fund future growth and expansion.

For example, consider a company with a retained earnings account balance of $37,000. This balance represents the cumulative net income that the company has earned and retained over time, after deducting any dividends paid to shareholders.

Sources of Retained Earnings

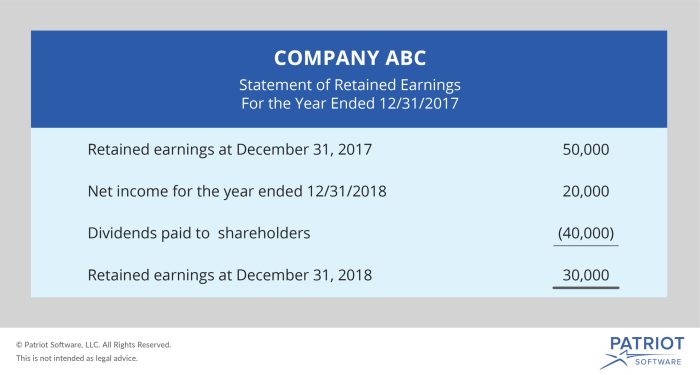

The primary source of retained earnings is net income. When a company generates net income, a portion of it is typically retained for reinvestment in the business. This retained income is added to the retained earnings account.

Prior retained earnings also contribute to the accumulation of retained earnings. Retained earnings from previous periods are carried forward and added to the current period’s net income to determine the total retained earnings balance.

Uses of Retained Earnings

Retained earnings can be used for various purposes, including:

- Reinvestment: Retained earnings can be used to finance expansion, research and development, or the acquisition of new assets.

- Dividends: A portion of retained earnings may be distributed to shareholders as dividends.

- Debt repayment: Retained earnings can be used to reduce debt obligations, improving the company’s financial leverage.

Analysis of Retained Earnings

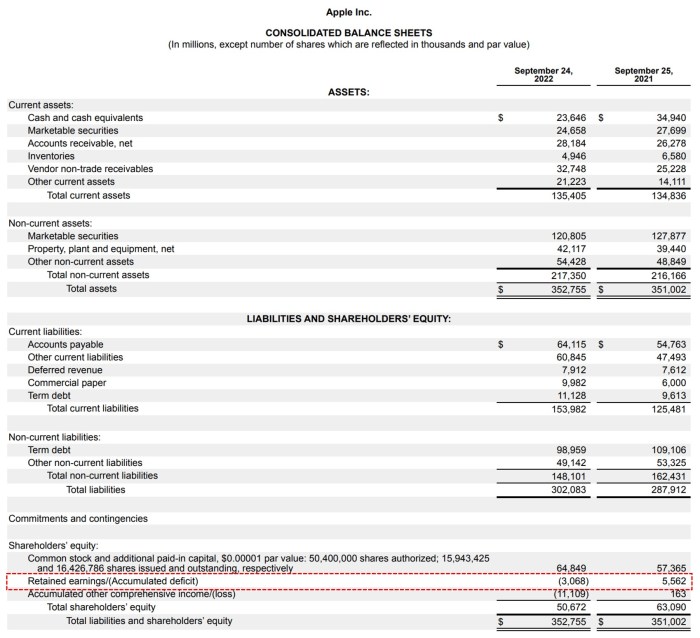

The retained earnings account with a credit balance of $37,000 indicates that the company has retained a significant portion of its net income over time. This suggests that the company is prioritizing reinvestment and growth rather than distributing earnings to shareholders.

A positive retained earnings balance is generally a sign of financial strength and stability. It provides the company with a financial cushion to withstand economic downturns and invest in future opportunities.

Comparison to Other Companies

To gain a comprehensive understanding of the company’s retained earnings position, it is useful to compare it to other companies in the same industry.

If the company has a higher retained earnings balance compared to its peers, it may indicate that it is more focused on internal growth and less reliant on external financing.

FAQ Corner: The Retained Earnings Account Has A Credit Balance Of 37000

What are the primary sources of retained earnings?

Retained earnings are primarily sourced from net income, which represents the company’s profit after deducting expenses and taxes.

How can companies utilize retained earnings?

Companies can use retained earnings for various purposes, including reinvestment in operations, payment of dividends to shareholders, and debt repayment.

What are the implications of a credit balance in the retained earnings account?

A credit balance in the retained earnings account indicates that the company has accumulated more earnings than it has distributed as dividends, demonstrating financial stability and growth potential.